Retention period for delivery notes - that will change in 2025!

Delivery notes serve the check and the confirmation of receipt. The retention periods are regulated in the Commercial Code as well as the Tax Code. However, they changed because of the Bureaucracy Relief Act 2025. We'll explain to you what you need to consider when it comes to delivery notes.

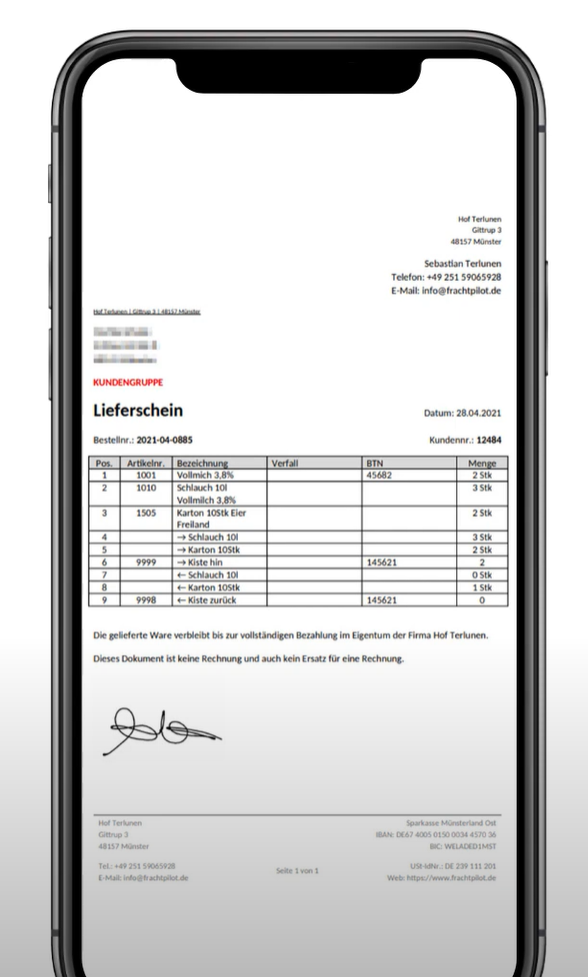

Delivery notes list the delivered goods. The main purpose of a delivery note is therefore to provide recipients with facilitate control whether the delivery is in line with the order. At the same time, they serve as exhibitors as a control tool for inventory. In addition, they can have suppliers confirm delivery by recipients acknowledging them.

Delivery notes may also contain an empty field where recipients can confirm receipt of the goods with place, date and signature. In this case, a copy is recommended. They do not include prices, so they cannot replace the invoice.

Delivery notes can also be issued in triplicate, one of which serves as proof of delivery, one remains with the supplier as confirmation and the third receives the receiving company. Delivery notes can also be part of the invoice and then contain the wording “Goods in accordance with delivery note No.”. It is important to note that the delivery note can be retrieved at any time, within the 8-year retention period that applies to invoices.

For companies that calculate profits via the cash accounting method, delivery notes play a subordinate role because only invoices that have already been paid are relevant. Delivery notes are therefore not included as accounting documents and are therefore more likely to be relevant for accounting undertakings. While the invoicing is mandatory companies are free to send delivery notes. Accordingly, delivery notes cannot replace invoices, but invoices can replace delivery notes.

Subject to storage are all who are required to keep accounts. However, delivery notes, which only the confirm shipment, are not relevant to booking and therefore the retention period of only 6 years applies for these as trade letters. It is different with delivery notes that at the same time function as a booking document or invoice. These must then be stored for 8 years, which is also possible digitally. One reason is that accounting documents are relevant for the financial statements.

Storage of accounting documents is regulated with 6 years in the Commercial Code (HGB § 238 ff.), as this is evidence between trading partners. The 8-year storage period comes from tax law, where the Tax Code §147 (AO) regulates that business transactions must be recorded GoBD-compliant. If an invoice is issued in addition to the delivery note, the storage obligation in accordance with tax and commercial law ends. However, storage can still be useful for documentation. As part of Bureaucracy Relief Act, whose innovations on January 1, 2025 came into force, the retention period was reduced from 10 to 8 years.

The Bureaucracy Relief Act is actually intended to relieve medium-sized companies. In fact, it's more of a relief for small businesses that don't exceed the turnover limits for double bookkeeping. There is also types of companies such as partnerships and corporations, which automatically commit to double bookkeeping. The Bureaucracy Relief Act was amended in 2025, which concerns many documents that are also relevant for many citizens. This includes, for example, employment contracts and certificates as well as tax assessments in digital form.

Even with delivery notes, it is required to comply with the GoBD. In addition to storage, this includes complete documentation, which must be unalterable and comprehensible. According to the GoBD it is also important that the supporting documents in the case of verification can be found which must be readable and be made available. Delivery notes can be stored digitally, but a scan is sufficient. Digital delivery notes via email make digital storage easier, but does not replace the goods receipt. At the safekeeping and organization document management systems, so-called DMS can be used. These can be helpful because they automate business processes.

Delivery notes are not mandatory, but can be helpful as an extra service. They do not contain any billing information and are kept as a delivery note for 6 years or 8 years if they function as accounting documents. With FrachtPilot you can create delivery notes automatically. If you're still looking for a suitable ERP software have a look at FrachtPilot or test the ERP system for free or get to know FrachtPilot in a free webinar. We're looking forward to seeing you!