E-billing in agriculture - what you need to know

The duty to e-bill has been valid since 2025. We'll explain to you which transition periods there are, whom they apply to and what else you need to know.

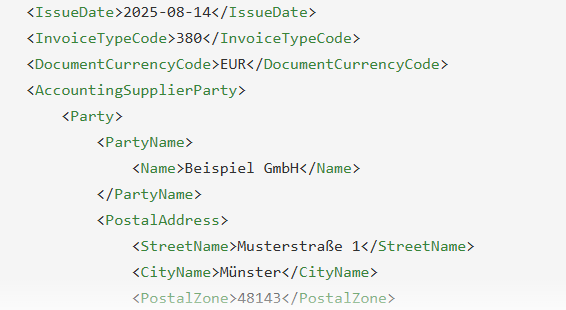

E-invoices are electronic invoice documents which, in addition to the digital presentation (for example as a PDF), include also a structured data set in XML format. This is exclusively machine-readable. Electronic transmission and processing should simplify and standardize document traffic. In terms of content, they do not differ from previous digital invoices. They include the following mandatory information:

Since January 1, 2025 must companies have to be able to receive and process e-invoices from other companies. This applies to all companies in the main and sideline. Until December 31, 2026 invoices can continiously be issued as paper or attached as PDF. This period is extended by one year if the annual sales do not exceed 800,000 euros. This limit is in line with the requirement double-entry accounting. From 2028, there is a general obligation to use e-billing. However, there is an exception for B2C customers, small amount invoices up to 250 euros and small entrepreneurs in accordance with §19 UStG. This means for part-time farms that you may still be sending digital or paper invoices by the end of 2027. For small businesses rules apply, as followed: Those whose turnover in the previous year is less than 25,000 euros and not more than 100,000 euros in the current year, may still make use of the exception even after the year 2027. This can also be relevant for regional direct marketing. From 2028, e-invoices must also be issued for small amount invoices.

No, a PDF as an invoice is not an electronic invoice. These are similar to image files. What remains the same, however, is the retention obligation in the sense of GoBD (principles of proper management of books, records and documents in electronic form as well as for data access) for electronic invoices from 10 years.

That XML format (Extensible Markup Language 'expandable description language') is similar to the layout of HTML (Hypertext Markup Language). Either they contain readable text and an attachment with this as an XML data set, or exclusively the machine-readable data set.

The common formats are XRechnung and ZUGFeRD. The latter stands for central user guide of the German Electronic Invoice Forum.

The XRechnung contains only the structured data set, while a ZUGFeRD invoice as hybrid format provides readable text in addition to the XML text. The advantage of ZUGFeRD is therefore that small businesses can initially receive and read invoices via email using this format.

Accordingly, an email address is sufficient to receive. To send e-invoices, an ERP software or other softwares How from DATEV will be needed. This is useful for direct marketing or farming. There are also free tools available for freelancers, for example, who only generate a few invoices per month.

E-invoices are standardized, machine-readable and can further processing without media breaksn. ERP systems like FrachtPilot You can also read electronic invoices directly with the and automatically post them. This reduces manual effort, saves time and paper and makes your day-to-day business easier. So you shouldn't worry about the change. At the same time, automatic processing makes an important contribution to progressive digitization and thus to implement the Growth Opportunities Act.

The e-invoicing requirement has also been in force in agriculture since January 1 2025, the obligation to send e-invoices will be coming in 2027 or 2028 with just a few exceptions. You should therefore take care of the changeover at an early stage. If you already use an ERP software like FrachtPilot in agriculture or direct marketing, it will be an automatic and easy changeover. If you still need an ERP system, have a look at us, book a free webinar or just test FrachtPilot for free. We're looking forward to seeing you!